By: Lotte Frost, Kvinner i business

In Norway and the Nordics, we’re proud of the possibilities and services we offer female entrepreneurs and start-ups. And compared to other countries, there are a lot of governmental support schemes one can apply to in order to get both funding and support. But, and that but is quite big, in regards to funding it’s all about the men.

Only 0,1% of all investments are in female start-ups

There’s a long way to go. Only 0,1% of investments in the start-ups in Norway was allocated to all female start-ups and 0,1% for mixed genders. This is an important finding in the report, “The start-up funding report”, developed by Unconventional Ventures. So that leaves 99,8% of all capital funding business allocated to all-male teams. At the same time, 38% of all start-ups, are female. A huge mismatch, and a huge disappointment as the report from Unconventional states. And the same goes for Finland and Iceland.

It’s a paradox, that in the survey, “The female Opportunity Index 2021”, Norway is ranked number one, closely followed by Finland and Iceland. So, the possibilities are available, but not the money.

The results are a little bit better in Sweden, Germany, UK, France and Denmark, but still almost 90% of all funding is invested into all-male companies.

Men invest in men

So, who are the investors? Yes, they are also male. A total of 84% of all capital is raised by funds with only male general partner.

Most decision makers are male, whom are also overrepresented in senior roles. In Norway 13,9% of all chairman of the board, or should we start saying chairwoman of the board, are women. But the share of female CEO is increasing and is now 37% on Norway.

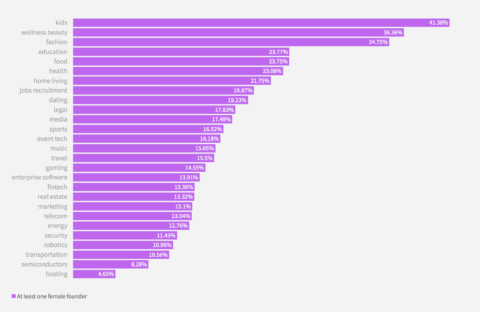

Kids is the most popular business

Most investors invest in female start-ups related to kids, wellness/beauty and fashion. In many ways traditional female industries. The over-all most popular industry to invest in is fintech, where all-women companies account for approximately 13% of the start-ups.

Time for action

We need action! Female entrepreneurs need to build a stronger position for the future. The authors of “The start-up funding report” reflects upon whether we need accelerator for investments instead of start-ups and they have some recommendations for moving forward:

– Educate traditional avenues of investing

– Promote more women to check-writing roles

– Publish your own findings

So, all female entrepreneurs, we need to challenge the exciting funding patterns by educating the investors and report our results and learnings. We need to promote ourselves, our businesses and our learnings.

Good luck.

Sources:

https://report2021.unconventional.vc/

https://www.ssb.no/

https://n26.com/en-eu/female-opportunity-index